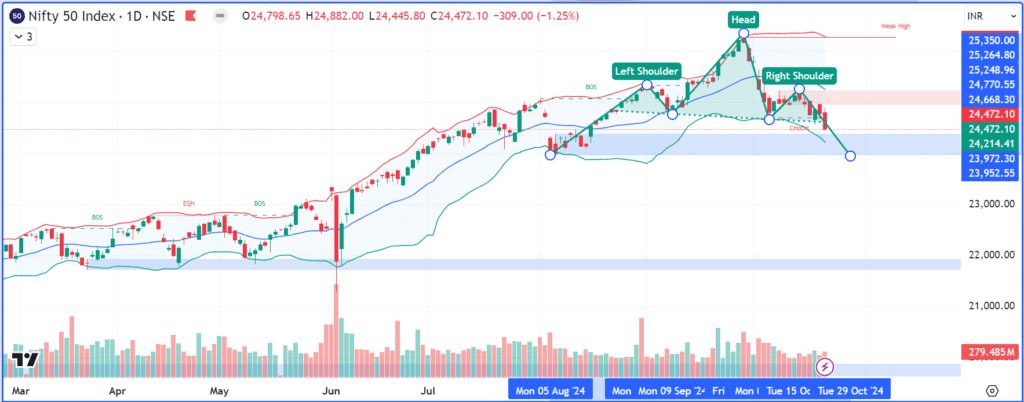

Wise investor knows how to grab the opprtunity while others are in fear of the Bears. Nifty has closed on 22-Oct-24 below 24500. In a previous update on 18-Oct-2024, Alfinia Academy had given an early heads up to investors that market was preparing for a much overdue and healthy correction. Nifty has triggered a clear Head & Should patter on the all time high. The first target is 23900 levels which is also the base of current supply zone.

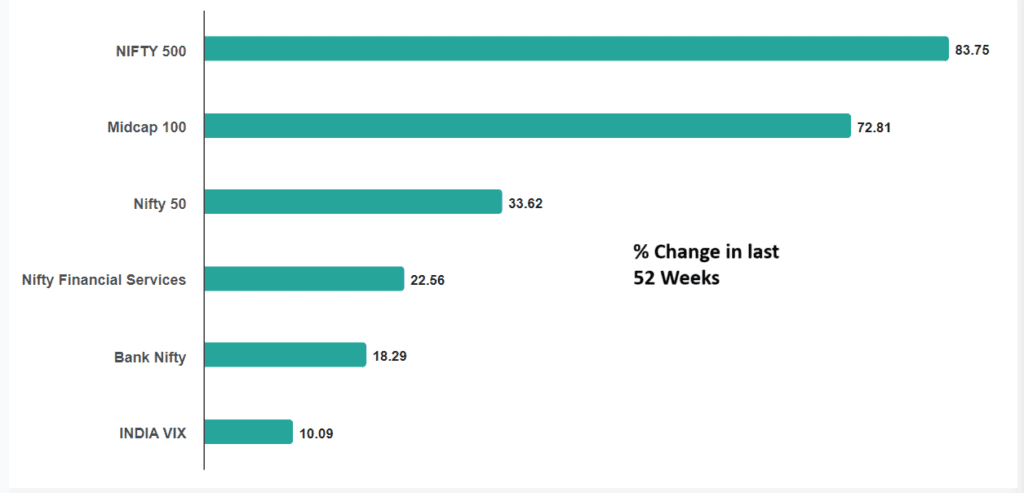

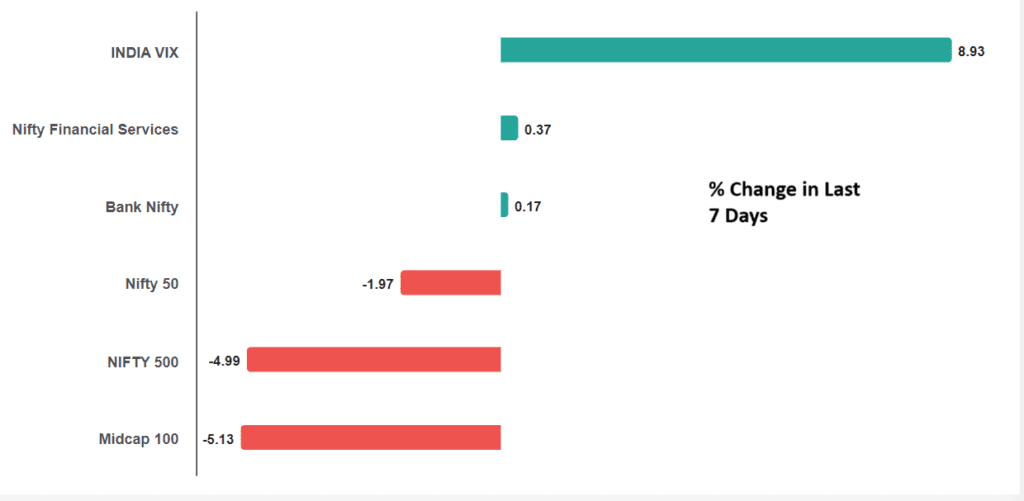

Markets are correcting in line with earlier rise. Apart from the highlight fact the market was on all time high, it is worth noting that SmallCap and MidCap had seen exception rise during last 52 weeks. Nifty 500 increased by 84% while MidCap100 increased by 73% during this period while Nifty50 had increased by 34%. Market correction is also responding to these movement where Nifty 500 and MidCap100 have corrected 5% each against 2% correction in Nifty50 in last 5 Days.

US Elections and increasing Bonds rates are not the apprect factors driving this correction as US market theseselves are continue to trade near all time high. Similarly, Brent Crude continue to be within normal range of 70-80$. Evidently, the correction is driven by internal factors of Weak Q2 Results and future business outlook quoted by the management.

Second reason for rally has been the flow of retail funds in India into market to an extent that Banking has been struggling with low savings deposits. Here, it is interesting to note that total DMAT accounts in India have increased from 4 Crores in 2020 to 16 Crores now. These new investors have not exprienced any market crack down or a major correction. If these investors start loosing their confidence, the large cash inflow may take a pause which can trigger really big market correction.

Market is at crucial level of breaking a strong Head & Should chart pattern. If closed for two more days in negative below 24,400, it may fall further to levels of 24000-23500. Any deep correction to 22500 levels is OUT OF SIGHT as of now as the long term India Growth story is still intact.

In conclusion, Some correction is not just OK, but rather much needed for Bullrun to continue and HIT new highs. Generally, 5-10% correction is considered to be good healthy correction for bull run to continue.

Business results are cyclical in long run, do Watchout for opportunities for potential K-Shape recovery post this healthy correction. Investors may wait for right signals from the market to invest 2nd and 3rd installment of fresh investments.

As smart Risk Mitigation Startegy, at this stage would be stay Neutral and keep positions light until the movement from current levels. Smart investors can delta neutral in their position and use Beta to hedge the portfolio using Derivatives.

Diversification of the Portfolio is an established tool to mitigate the concentration risk minimizing the impact of familiarity bias. Such short to medium term corrections can be managed effectively with Hybrid portfolio management also.

Most Important, don’t Panic and use the market volatility to pump up the returns on you portfolio. Refer to the Morning Market Update from OptionGurukul for the expert view on active trading.

Keep Investing in yourself! Cost of Upskill is always less that Cost of Ignorance!!